Legacy Pension Managers Limited is now FCMB Pensions Limited

As part of the strategy to harmonize its global brand and identity, FCMB Group Plc has announced a change of name in the pension management arm of its business. Formerly known as Legacy Pension Managers Limited, the leading financial services holding company’s fund managers firm will now be known as FCMB Pensions Limited. In a statement released in Abuja, the Federal Capital Territory, the Group said, following the acquisition of majority shareholding in the company by FCMB Group Plc and the approval of the Board of Directors at its meeting of October 17, 2018, the change of name will positively enhance the company’s marketing and distribution activities.

Reacting to Media inquiries, the Managing Director of FCMB Pensions Limited, (formerly Legacy Pension), Mr. Misbahu Yola, notifying shareholders said, “what has happened is expected and an important alignment of our marketing message. There has been a comprehensive integration of the pensions business into FCMB Group, which is known for its culture of excellence, resilience and customer focus. It is another way of welcoming it to a group that has endured and enjoyed stability and sustainable growth in the last 41years”. FCMB Group Plc is a leading financial services group with businesses in commercial and retail banking, investment banking and wealth management, across seven subsidiaries that was founded in 1977 and became a public listed company in 2005. FCMB increased its stake in its pensions business between 2017 and 2018 from 28.3% to 91.6% currently. The acquisition is expected to engender sustainable and diversified low-risk growth momentum. The pension firm will also leverage on FCMB’s extensive distribution network, alternate channels, digital innovation, investment research, and rapidly expanding customer base.

Chairman of the Board of FCMB Pensions Limited and the Group Chief Executive of FCMB Group Plc, Mr. Ladi Balogun said, “the change of the company’s name will entrench a single brand identity across our pensions and retail banking businesses. Having distinguished ourselves in consumer finance over the years and gaining greater market share in retail payments solutions and savings accounts, a comprehensive suite of asset and wealth management propositions is a natural addition to our growing base of 5 million customers. The brand harmonization will enable us create greater marketing synergies and, along with other initiatives, accelerate the growth of our pensions business”.

FCMB Launches Education Advisory Services for Overseas Studies

Leading financial services provider, First City Monument Bank (FCMB), has unveiled a scheme tagged, ‘’FCMB Education Advisory Service’’, that would ensure convenient and affordable education support for its customers who or their children desire to study abroad and obtain undergraduate and post-graduate degrees. The support includes overseas admission information services, school fees remittance, school living allowances and travel fares, loans to support school fees payments, visa process, travels and examination preparation. Access to customers and other aspiring candidates is said to be available on FCMB website with branches where operational desks are currently located, listed. It is part of the Bank’s contributions towards developing a new generation of brilliant minds that would take Nigeria to the next level. The scheme is in partnership with MOD Group, a foremost international education promotion and marketing company with operations deeply rooted in Nigeria and covering the West Africa sub-region. Under the initiative which was launched at a ceremony on May 30, 2018 in Lagos, FCMB is offering a full range of core financial services, tailored to meet the needs of its customers in the area of acquiring education abroad. This is in addition to a wide range of benefits that the Bank is providing for potential and existing students under the Education Advisory Service initiative.

Among these are, up to N5million school fees support to customers from the Bank and Credit Direct Limited, one of the subsidiaries of FCMB Group Plc (the holding company), Flexx account (in foreign exchange) for students going abroad to study, prompt and secure international funds transfer through internet banking platforms for the payment of school fees and other educational expenses abroad. There is also the issuance of FCMB debit cards, including the pocket money card (pre-loaded) that can be used to withdraw cash from overseas ATMs and make payments at stores and supermarkets. On the other hand, MOD Group will provide advisory services, such as, school admission processing, visa processing and examination preparation for beneficiaries of the FCMB Education Advisory Service. Speaking at the launch of the initiative, the Executive Director, Retail Banking of FCMB, Mr. Olu Akanmu, stated the commitment of the Bank to champion and execute initiatives that would promote education and knowledge acquisition among Nigerians. According to him, ‘’at FCMB, we walk and work with our customers to fulfil their life aspirations for themselves, their families and their businesses, including the provision of the best education. The FCMB Education Advisory Services in partnership with MOD Services and international partners also covers school admission process, Visa processing, travel and examination Preparation. We recognise that knowledge of what to do and how to do it matters in securing good overseas education. FCMB will also be providing prompt school fees and living allowances remittance, loans to support school fees payment and international cards to support living overseas for Nigerian students

Mr. Akanmu also added, ‘’we have Lufthansa Airline, beside other partner airlines on board to offer students, discounted fares under this scheme. This also covers their guardians accompanying them. In addition, we have AXA Mansard coming on board to provide medical cover for the students to the tune of $60,000 a year’’. Also speaking at the ceremony, the Managing Director of MOD Group, Mr. Michael Dosunmu, expressed gratitude to FCMB for the partnership. According to him, ‘’one of the major challenges faced by Nigerians who desire to study abroad is funding and the necessary information to achieve this. We believe that with our partnership with FCMB, through the platform of the Education Advisory Service, this challenge will be addressed. By providing a platform for Nigerians, especially young ones to study abroad, we will be helping to develop a new set of manpower equipped with the required international exposure, knowledge and skills to champion the development of the country. We therefore urge all those who have big dreams for their children and families to take advantage of this opportunity’’. The Permanent Secretary/Tutor General, Ministry of Education in Lagos State, Mrs. Olufunmilayo Onadipe, described the Educational Advisory Service scheme as a step in the right direction. She stated that, ‘’education is the bedrock of any society. For FCMB and MOD Group to come up with this package is an indication that they are committed to providing the necessary support to assist families and our young ones develop academically. I will appeal to FCMB to also accommodate wards from public schools, as they also desire the same foreign education’’.

On his part, Head of Communications, British Council, Mrs. Edemekong Uyoh, said, ‘’we consider the FCMB Education Advisory Service as an initiative that would give opportunities for young Nigerians and enhance capacity. The more educated we are, the more we can add value to our lives, economy and the society. At the British Council, we are particular about providing young people with pathways for the future. This is one of the initiatives that also align with our objectives and we are happy to associate with it’’. Also commenting on the scheme, a Representative of the High Commission of Ireland, Tessa Bagu harped on the importance of education. She stated that, ‘’education is the key to the future and development of a country. It is knowledge that drives development. Ireland is one of the leading economies in Europe today because of the high level of education of the people. We are optimistic that through the partnership between FCMB and MOD Group, Nigeria will grow further’’.

FCMB Assures of Enhanced Performance as Shareholders Approve Results at AGM

Lagos: April 27, 2018: FCMB Group Plc is on a stronger pedestal and will continue to provide superior performance that would add significant value to stakeholders in a sustainable manner in spite of the challenging macroeconomic and regulatory environments. The financial institution added that its subsidiaries are well positioned to deliver more cutting-edge solutions that would provide the best customer experience in their respective target markets.

The assurance was given at the 5th Annual General Meeting (AGM) of FCMB Group Plc, a holding company comprising eight entities, namely First City Monument Bank Limited, FCMB Capital Markets, CSL Stockbrokers Limited, CSL Trustees Limited, Legacy Pension Managers Limited, FCMB (UK) Limited, First City Asset Management Limited and Credit Direct Limited, held on Friday, April 27, 2018 in Lagos.

Going by its audited accounts for the year ended December 31, 2017, FCMB Group Plc recorded a gross revenue of N169.9 billion and a profit before tax (PBT) of N11.5billion, while profit after tax (PAT) was N9.4billion. In addition, deposits grew to N689.9billion as at the end of December 2017, an increase of 5%, from N657.6billion in the previous year. The Group’s capital adequacy ratio also improved to 16.9% from 16.7%, just as asset base increased to N1.19trillion, compared to N1.17trillion at the end of 2016. Non-interest income as at the end of 2017 was N32billion, while loans and advances stood at N649.8billion.

Presenting the Chairman’s report, Mr. Oladipupo Jadesimi said:

‘’We will continue to shore up the capital of the bank through profit retention in preparation for the growth opportunities that we expect as the economy recovers’’.

The new Chairman of the Board of FCMB Group Plc expressed gratitude to shareholders for their continuous support, adding that:

‘’Although we met with a number of challenges as a Group in 2017, I am pleased to say that we were able to surmount them, thanks to the commitment of all the personnel of our Group companies’’.

Also speaking at the AGM, the Group Chief Executive of FCMB Group Plc, Mr. Ladi Balogun, said:

‘’In spite of the reduction in headline numbers, Group performance is an improvement over the previous year after adjusting for the significant FX (foreign exchange) revaluation income enjoyed in 2016. The key drivers of the Group’s performance include increase in income from our non-banking activities, lower impairment charges from the bank and its subsidiaries, and improved operating efficiencies through more pervasive use of technology’’.

Mr. Balogun assured that FCMB Group Plc’s successful acquisition of majority (88.2%) stake in Legacy Pension Managers Limited will go a long way to help achieve further diversification of service offerings and consequent earnings within the FCMB Group. He said:

“ We see significant growth opportunities in the Pension management industry in Nigeria as it is yet to achieve maturity and will support and facilitate strategic organic and inorganic growth initiatives that will position Legacy in the top-tier of its industry over the next few years’’.

Concerning the performance of the flagship of the holding institution, First City Monument Bank Limited, the Commercial and Retail Banking member of FCMB Group Plc, the Group Chief Executive told the meeting it:

‘’showed signs of improvement with growth in income levels (after adjusting for exceptional FX revaluation income in 2016), reduction in impairment charges and substantial growth in our UK business and consumer finance business (CDL), after a difficult 2016. Commercial and Retail Banking remains our largest group, contributing 76.2% of profits and 98.5% of total assets’’.

He, in addition stated that the Investment Banking arm:

‘’Exhibited improved performance, from a loss position in 2016 of N84.0million after tax to a profit position of N430.3million after tax in 2017, largely driven by CSL Stockbrokers Limited. Our stockbroking business remains a top-3 player in its sector and participated as the sell-side broker on the largest ever trade on the Nigeria Stock Exchange in December 2017. CSLS Stockbrokers Limited and FCMB Capital Markets Limited jointly accounted for 4.1% of profits’’.

FCMB Restates Commitment to Tourism, Felicitates with Ijebuland on Ojude Oba Festival

PRESS RELEASE

First City Monument Bank (FCMB) Limited has reiterated its commitment to support activities that promote and add value to Nigeria’s culture and heritage which are alsocapable of boosting tourism and other non-oil sectorsin line with the Federal government’s ongoing drive to diversify the country’s economy. According to the Bank, this is the rationale behind its decade long support for the annual Ojude Oba Festival, a carnival-like celebration of the traditional, cultural, spiritual, economic and other accomplishments of the people of Ijebuland in Ogun state. Consequently, FCMB has assured its stakeholders that its participation in this year’s Festival, which holds in Ijebu-Ode on September 3, 2017 will be grand, exciting and rewarding for the thousands of people within and outside the country that would grace the fiesta. The Group Head, Corporate Affairs of FCMB, Mr. Diran Olojo, gave the assurance at a press conference held on August 22, 2017 at Ijebu Ode, to kick-off activities for the Festival. FCMB has over the years been a major sponsor of the Ojude Oba Festival and has continued to play a significant role in ensuring its success.

The Ojude Oba (which in Ijebu dialect means, the king’s fore-court or frontage) is a major festival in Nigeria that began over 100 years ago. It brings together all sons and daughters of Ijebuland in Nigeria and diaspora. During the Festival, various age groups (popularly known as the Regberegbes), indigenes, their friends and associates from far and near – all in their colourful costumes and riding on horses – throng the palace of the Awujale and Paramount Ruler of Ijebuland to pay homage to him amidst prayers, songs, tributes and other fun-filled activities. Apart from serving as a distinctive platform to reconnect with the values that sustain the town’s rich history, heritage and industrious uniqueness, the festival also goes a long way to boost business activities, tourism and the general hospitality sector in the area.

In a goodwill message to the Awujale of Ijebuland, Oba (Dr.) Sikiru Adetona, the Group Chief Executive of FCMB Group Plc, Mr. Ladi Balogun, congratulated the monarch, sons and daughters of Ijebuland for promoting the values of the ancient city through the festival and other socio-economic activities. He stated that FCMB is committed to the longevity of the Ojude Oba Festival and the economic prosperity of Ijebuland, just as he urged the people to see the Festival as a fulcrum to inspire individuals and businesses for heightened creativity and increased productivity. According to him, ‘’over the years, the Ojude Oba Festival has grown to become the most popular gathering of the people of Ijebuland and a significant tourist attraction. With her large diaspora population, talented artists and rich cultural diversity, Nigeria is well positioned to reap the opportunities that globalisation presents to showcase her artistry and festivals, whilst bringing increased economic activity to communities that host such, such as Ijebu Ode. As we seek to diversify our economy, tourism and culture represent a low hanging fruit that must not go untapped’’.

In the same vein, the Founder of FCMB Group who is also the the Olori Omo-Oba Akile Ijebu, Otunba (Dr.) Michael Olasubomi Balogun, CON, in a goodwill message to the paramount ruler of Ijebuland expressed his gratitude to the Awujale, especially the paramount ruler’s selflessness in attending to the different requests and yearnings of the people of Ijebuland. In a message delivered on his behalf by Mr. Diran Olojo, the Bank’s Head of Corporate Affairs, Otunba Balogun commended Oba Adetona for his distinguished and exemplary leadership over the years. ‘’I for one continue to be proud as your Olori Omo-Oba to lead the way in showing our appreciation by being very close to you and showing unflinching loyalty. Let me thank you and the good Lord, our Maker that you have been unrelenting in showing that you appreciate my regular homage and tribute to you. I can say without fear of anybody gainsaying it that from year to year, on a daily basis, the appreciation of all Ijebus for the way you extend yourself to their different requests and yearnings, is such that the annual paying of homage, is not just the only occasion we would want to be showing our appreciation because you continuously earn our affection and our adulation’’, Otunba Balogun emphasised. while congratulating the entire indigenes of Ijebuland, the FCMB Founder also prayed that the monarch’s reign would continue to bring joy and prosperity in abundance to the entire Ijebu race, at home and in the diaspora.

First City Monument Bank (FCMB) is a member of FCMB Group Plc, which is one of the leading financial services institutions in Nigeria with subsidiaries that are market leaders in their respective segments. Having successfully transformed to a retail and commercial banking-led group, FCMB expects to continue to distinguish itself by delivering exceptional services, while enhancing the growth and achievement of the personal and business aspirations of its customers.

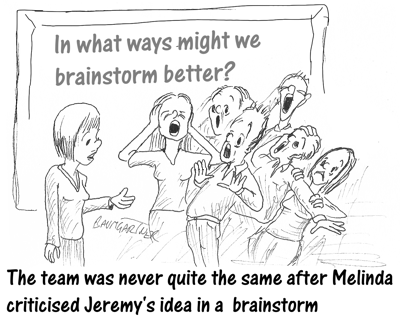

Actually, Criticizing Ideas Is Good for Creativity By Jeffrey Baumgartner

Ever since it was first invented by Alex Osborn in the 1950s or so, the fundamental rule of brainstorming, and just about every creative thinking method, has been, “Though shalt not criticise ideas.”

Mr Osborn never made it entirely clear why it is so bad to criticise ideas, though it is implied that you might hurt people’s feelings, inhibit creativity and possibly emotionally scar someone for life. Clearly then it is best to welcome all ideas with compliments, even if they are stupid, and never, ever criticise an idea. At least, that was the assumption

No one dared question this assumption for more than half a century − until 2008 when a couple of bright sparks at Berkeley University, Matthew Feinberg and Charlan Nemeth*, decided it was time to ask some questions. They conducted a study in which they put volunteers into teams and divided those teams into three three groups. One group followed traditional brainstorming rules. The second group were also told to follow brainstorming protocol with the exception that they were actively encouraged to criticise ideas. The third group was the control group. They were just told to come up with ideas any way they wanted to do.

So, what happened?

The control group’s outcome was the least creative. Only moderately better were the traditional brainstormers. By far the most creative group was the group that had been encouraged to criticise ideas.

This surprised a lot of people, especially people involved in creative facilitation. Their fundamental rule had been proven to be, well, completely wrong. Many professional brainstorming facilitators simply denied the results rather than accept their method might be flawed.

Others tried brainstorming and other ideation methods in which we actively encourage criticism during the ideation. I certainly did. And, I found it was surprisingly effective. In my experience, results are far better than when criticism is forbidden.

I believe there are several reasons why this is so.

- Blindly praising every idea encourages mediocrity. Why be bold when your boring ideas get praise?

- Criticising an idea starts a conversation about the idea as well as your needs, restrictions, assumptions and more. When ideas cannot be criticised, you cannot delve into them. You cannot really discuss them. You certainly cannot build upon them until you’ve discovered the weaknesses that need improving.

- Criticising an idea gives it importance. When all ideas are “great” the compliment becomes meaningless. When someone stops to listen to an idea, thinks about it and addresses its weaknesses, she is saying, “this idea has meaning to me. I want to talk about it.”

- Criticising ideas gives guidance. If an idea is criticised, debated and rightly found not to be viable, this tells people to think in a new direction.

No Downward Spiral

Brainstorm fans often worry that allowing criticism of ideas will lead to a downward spiral where everyone is negative and no new ideas are developed. In my experience, this does not happen. I believe it is because when a group of people in an organisation are trying to build ideas, they have a common goal in building a relevant idea that achieves their needs. Bring relentlessly critical will not get them to their goal. Being productively critical will.

Three Rules

In anticonventional thinking (ACT), an alternative to brainstorming that encourages criticism, there are three rules.

- Always criticise boring, conventional ideas. You do not want them.

- Criticises the idea is OK; criticising the person is not OK.

- Once you have criticised and idea, shut up and let the originator of the idea, or anyone else, defend it.

I have found these rules, together with encouragement to criticise ideas, ensures that critical discussions are meaningful and feelings are not hurt. Ironically, several people have told me after ACT sessions that criticism of ideas makes them feel freer and less constricted than when they cannot criticise ideas.

Go On, Give It a Try

If you run brainstorms and have always adhered to Mr Osborn’s rule that you must withhold criticism, I suggest you experiment with ideation that welcomes crticism and see what happens. Mr Osborn surely would not mind. After all, he was a fan of creativity and trying out new ideas. Moreover, I believe you will be pleasantly surprised by the results.

- Published in Blog

AXA MANSARD SPONSORS WEST AFRICAN COLLEGE OF SURGEONS’ (WACS) COMMUNITY OUTREACH PROGRAM

In furtherance of its commitment towards the provision of quality healthcare to Nigerians of diverse socio-economic backgrounds, AXA Mansard co-sponsored the Ibadan Community Outreach Program, organized by the West African College of Surgeons (WACS).

The program was a 4-day community outreach organized by the West African College of Surgeons (WACS) and the Oyo State Government at the General Hospital, Aremo, Ibadan from Monday, November 23 to Thursday November 26. The College of Medicine, University of Ibadan, the University College Hospital, Ibadan and the Association of General and Private Medical Practitioners of Nigeria (Oyo State) actively participated in the program, which comprised health education talks, health screening and provision of intermediate surgical procedures.

Free medical services were provided for over 1700 cases, including general health checks and screening, urological diseases, obstetrics and gynecology diseases, primary dental and ophthalmological care as well as provision of eye glasses amongst others.

Mr. Tope Adeniyi, the Chief Executive Officer of AXA Mansard Health Limited commented that this initiative is part of AXA Mansard’s contribution towards improved health care delivery to Nigerians.

Professor Olapade Olaopa, Chairman of the Local Organising Committee, representing the Chairman, West African College of Surgeons Outreach Program, thanked AXA Mansard on behalf of the President and Council of the WACS for the continuous support towards the actualization of the goal of the committee which is to improve the overall health of members of the public and lead everyone to a better and healthier life.

AXA Mansard rated among Top 50 Brands in Nigeria

AXA Mansard Insurance continues to receive top ratings amongst other brands. AXA Mansard Insurance was rated among the Top 50 Brands in Nigeria by APT Brand International Limited.

Top 50 Brands in Nigeria is an annual selection of top brands in Nigeria. The award criteria include leadership structure, market acceptance, brand equity, product offerings, culture, quality service delivery and market performance.

The record is indeed significant for AXA Mansard Insurance as it is the only insurance company to receive this outstanding recognition along with other highly rated brands in the country.

The Chief Client Officer, Tosin Runsewe commented that “Our brand has grown over time and has become a symbol of our desire to keep evolving new ways of pleasing our customers. The value of our brand represents the value we place on our customers and serves as a hallmark of our brand promise to them to protect their assets, health and loved ones”.

Adding to this, the Group Head Strategy and Marketing, Kola Oni, says “We are delighted to receive this award for the second year in a row. The AXA Mansard brand is unique and this award is dedicated to our customers who have supported us over time even as they recognize and appreciate the AXA Mansard experience”.

SUPER SEVEN FC PICKS NIGERIA’S TICKET TO REGIONAL FINAL

Nigeria is to be represented at the regional circuit of the ongoing Standard Chartered Bank’s Road to Anfield five-a-side competition by Super Seven FC.

Mrs Yetunde Oni, Head Commercial Clients, Standard Chartered Bank (3rd left), presenting the Trophy to Captain of Super Seven Football Club, Ojo Babatunde Damilola, the winner of the just concluded Standard Chartered Road to Anfield 2015 competition.

Super Seven bagged the ticket to the regional final in Accra, Ghana after defeating Dobber FC 6-5 in a penalty shoot-out at the Astro Turf ground in Lekki, Lagos. Neither of the two sides could end the scoreless deadlock at regulation time. Also to join Nigeria and host Ghana at the Accra soccer fiesta is The Ghana. The three are to battle for the West African ticket to Anfield in the UK where the winners of the East and Southern African regions will also play.

According to the Sub-Regional Head, Brands & Marketing, West Africa of Standard Chartered Bank, Diran Olojo, the ‘Standard Chartered Trophy’ is an international five-a-side football tournament organised by the bank in partnership with Liverpool FC.

“It offers football fans a once in a life time, money can’t buy, opportunity of playing at an English Premier League football pitch as well as been coached by Liverpool FC’s Manager, Brenda Rodgers,” observed Olojo at the trophy presentation at the weekend.

Standard Chartered’s global footprints will compete for the ultimate trophy on May 7 and 8, 2015. The winners of the ‘Finals’ will be crowned overall champions of the ‘Standard Chartered Trophy 2015’.

Also speaking at the end of the national final last Sunday, Country Head, Corporate Affairs, Standard Chartered Bank, Nigeria, Dayo Aderugbo, expressed her happiness at the level of performance of the players and the huge turnout of football fans.

“I am so excited with the level of performance. We have a huge turnout. 36 teams registered and contested in the championship. So, regardless of the club you support, it’s a chance to come together and win together and go and play in Anfield, the home of Liverpool FC,” she noted with excitement.