FCMB partners WSBI to boost financial inclusion and savings in Nigeria

First City Monument Bank (FCMB) is set to substantially increase its support to agribusiness, its value chain and growth of the Nigerian economy after signing a Memorandum of Understanding with the World Savings and Retail Banking Institute (WSBI). The memorandum outlines a framework to deepen agency banking, financial inclusion and savings culture in the informal and agribusiness sectors. As part of the terms of the partnership, in addition to the stated areas of support, WSBI will provide technical oversight supervision on a regular basis to ensure the achievement of mutually agreed goals set by both institutions. According to the memorandum, the project involves FCMB rolling out an integrated savings account – named ‘Kampe Account’ – to offer financial services under phase one of its plan to 150,000 unbanked and under-banked farmers across five states through agricultural agents operating under the bank’s agency banking proposition. The first set of states to benefit in this first phase are Kaduna, Kano, Nasarawa, Ogun and Oyo. The plan is to reach 2 million farmers across the entire nation by year 2023.

In addition to the financial support to farmers, FCMB plans to deploy its state-of-the art technology and mobile banking solutions to drive the project mainly in the rural and sub-urban farm settlements where most farmers are based. The bank will also organize capacity-building programmes for farmers aimed at facilitating their understanding of the sector and promote innovative ideas that would make the sector attractive, ultimately facilitating job creation that would in turn, impact on productivity and income. Commenting on the grant from WSBI and the initiative, FCMB’s Managing Director and Chief Executive, Mr. Adam Nuru noted the development will revolutionize agribusiness – one of the various empowerment strategies adopted by the bank that is appreciated by stakeholders within and outside Nigeria.

According to him, ”partnering with WSBI and harnessing the business model we have developed to drive it, under our Kampe Account, is built on a sustainable approach which ensures farmers can gain better access to finance and other resources needed to help them build successful businesses.” Nigerian smallholder farmers have been at a disadvantage due to several factors including land fragmentation, inadequate farming equipment, broken value chains, poor access to finance and inadequate cash flow. Over the years, they have suffered from lack of essential services such as access to good markets to create low economies of scale, challenges in the promotion of agricultural productivity, hurdles in their bid to achieve increase in food security to improve rural livelihoods for engendering systematic growth out of poverty. FCMB and WSBI are optimistic that these challenges will be addressed.

Mr. Nuru added: “Farmers who benefit from this effort can and should make the best use of the opportunity. FCMB will continue to partner with WSBI to create opportunities that would ensure the realization of the personal and business needs of customers.” WSBI Managing Director Chris De Noose concluded: “The Kampe Savings Project is yet another example of the innovative ways rural communities can flourish through mobile savings and beyond. Expanding banking access and agricultural services through the provision of mobile services to the farming community, which increasingly includes more women, can help knock out any doubt about the payoff that farming can bring.”

About FCMB

First City Monument Bank (FCMB) Limited is a member of FCMB Group Plc, which is one of the leading financial services institutions in Nigeria with subsidiaries that are market leaders in their respective segments. Having successfully transformed to a retail banking and wealth management led group, FCMB expects to continue to distinguish itself through innovation and the delivery of exceptional services.

About WSBI

The World Savings and Retail Banking Institute (WSBI), founded in 1924, represents the interests of 6,000 savings and retail banks globally, with total assets of $15 trillion and serves approximately 1.3 billion customers in nearly 80 countries (as of 2016). The Institute focuses on international regulatory issues that affect the savings and retail banking industry. It supports the achievement of sustainable, inclusive, balanced growth and job creation, in industrialized and less developed countries.

FCMB Launches Education Advisory Services for Overseas Studies

Leading financial services provider, First City Monument Bank (FCMB), has unveiled a scheme tagged, ‘’FCMB Education Advisory Service’’, that would ensure convenient and affordable education support for its customers who or their children desire to study abroad and obtain undergraduate and post-graduate degrees. The support includes overseas admission information services, school fees remittance, school living allowances and travel fares, loans to support school fees payments, visa process, travels and examination preparation. Access to customers and other aspiring candidates is said to be available on FCMB website with branches where operational desks are currently located, listed. It is part of the Bank’s contributions towards developing a new generation of brilliant minds that would take Nigeria to the next level. The scheme is in partnership with MOD Group, a foremost international education promotion and marketing company with operations deeply rooted in Nigeria and covering the West Africa sub-region. Under the initiative which was launched at a ceremony on May 30, 2018 in Lagos, FCMB is offering a full range of core financial services, tailored to meet the needs of its customers in the area of acquiring education abroad. This is in addition to a wide range of benefits that the Bank is providing for potential and existing students under the Education Advisory Service initiative.

Among these are, up to N5million school fees support to customers from the Bank and Credit Direct Limited, one of the subsidiaries of FCMB Group Plc (the holding company), Flexx account (in foreign exchange) for students going abroad to study, prompt and secure international funds transfer through internet banking platforms for the payment of school fees and other educational expenses abroad. There is also the issuance of FCMB debit cards, including the pocket money card (pre-loaded) that can be used to withdraw cash from overseas ATMs and make payments at stores and supermarkets. On the other hand, MOD Group will provide advisory services, such as, school admission processing, visa processing and examination preparation for beneficiaries of the FCMB Education Advisory Service. Speaking at the launch of the initiative, the Executive Director, Retail Banking of FCMB, Mr. Olu Akanmu, stated the commitment of the Bank to champion and execute initiatives that would promote education and knowledge acquisition among Nigerians. According to him, ‘’at FCMB, we walk and work with our customers to fulfil their life aspirations for themselves, their families and their businesses, including the provision of the best education. The FCMB Education Advisory Services in partnership with MOD Services and international partners also covers school admission process, Visa processing, travel and examination Preparation. We recognise that knowledge of what to do and how to do it matters in securing good overseas education. FCMB will also be providing prompt school fees and living allowances remittance, loans to support school fees payment and international cards to support living overseas for Nigerian students

Mr. Akanmu also added, ‘’we have Lufthansa Airline, beside other partner airlines on board to offer students, discounted fares under this scheme. This also covers their guardians accompanying them. In addition, we have AXA Mansard coming on board to provide medical cover for the students to the tune of $60,000 a year’’. Also speaking at the ceremony, the Managing Director of MOD Group, Mr. Michael Dosunmu, expressed gratitude to FCMB for the partnership. According to him, ‘’one of the major challenges faced by Nigerians who desire to study abroad is funding and the necessary information to achieve this. We believe that with our partnership with FCMB, through the platform of the Education Advisory Service, this challenge will be addressed. By providing a platform for Nigerians, especially young ones to study abroad, we will be helping to develop a new set of manpower equipped with the required international exposure, knowledge and skills to champion the development of the country. We therefore urge all those who have big dreams for their children and families to take advantage of this opportunity’’. The Permanent Secretary/Tutor General, Ministry of Education in Lagos State, Mrs. Olufunmilayo Onadipe, described the Educational Advisory Service scheme as a step in the right direction. She stated that, ‘’education is the bedrock of any society. For FCMB and MOD Group to come up with this package is an indication that they are committed to providing the necessary support to assist families and our young ones develop academically. I will appeal to FCMB to also accommodate wards from public schools, as they also desire the same foreign education’’.

On his part, Head of Communications, British Council, Mrs. Edemekong Uyoh, said, ‘’we consider the FCMB Education Advisory Service as an initiative that would give opportunities for young Nigerians and enhance capacity. The more educated we are, the more we can add value to our lives, economy and the society. At the British Council, we are particular about providing young people with pathways for the future. This is one of the initiatives that also align with our objectives and we are happy to associate with it’’. Also commenting on the scheme, a Representative of the High Commission of Ireland, Tessa Bagu harped on the importance of education. She stated that, ‘’education is the key to the future and development of a country. It is knowledge that drives development. Ireland is one of the leading economies in Europe today because of the high level of education of the people. We are optimistic that through the partnership between FCMB and MOD Group, Nigeria will grow further’’.

Standard Chartered renew LFC partnership Partnership extended to run until end of 2022/23 season

Liverpool Football Club and Standard Chartered Bank are pleased to announce a four-year extension to their main sponsor agreement, taking the Bank’s partnership with the Club through to the end of the 2022/23 season. The Bank first signed up as the Club’s main sponsor in July 2010, and the agreement was extended in 2013 and again in 2015. Financial terms of the agreement remain confidential. Liverpool FC has a large number of fans across Standard Chartered’s core markets in Asia, Africa and the Middle East and the sponsorship provides the Bank with an opportunity to accelerate visibility of its brand, improving recognition across key markets around the world.

Additionally, over the last eight years Standard Chartered and Liverpool FC have used their partnership to support a number of the Bank’s sustainability and community investment programmes. The annual ‘Perfect Match’ game – where LFC players swap the Standard Chartered logo on their shirts for the Seeing is Believing logo – has raised more than USD480,000 to tackle avoidable blindness. Billy Hogan, Managing Director and Chief Commercial Officer, Liverpool Football Club said: “As a Club we’re very proud to have Standard Chartered renew their relationship for another four years. Our connection runs deep, it means more than just sponsorship, from the outset it has been about working together with the Club and our communities and supporters around the world. “Importantly, it also means we are able to support our ambitions on the pitch and compete with the best in the world. We have enjoyed many highlights of this relationship so far and I look forward to many more.”

Bill Winters, Group Chief Executive, Standard Chartered, said: “Liverpool FC is one of the world’s best-known football clubs and we are proud to be associated with them. It is a fantastic club that shares many of our values and is hugely popular across our global footprint. Our partnership has provided valuable support to the charitable initiatives close to our hearts and has helped us to further engage with our clients and staff as well as with LFC fans. We are excited to be able to continue this partnership, and look forward to building on our successful relationship.”

FCMB Attains ISO Certification for Quality Management

Leading financial services provider, First City Monument Bank (FCMB), has been awarded the prestigious International Organisation for Standardisation (ISO) 9001:2015 certificate for Quality Management System. The Bank was presented with the certificate by the Standards Organisation of Nigeria (SON), following a comprehensive audit and evaluation exercise conducted by the Organisation. The exercise covered departments and branches of the lender, nationwide. The development is coming on the heels of the renewed strategic focus of FCMB, which has significantly deepened its core values of of Professionalism, Sustainability, Customer Focus and Excellence. Through this process, it was observed the Bank had successfully overhauled and streamlined its processes, procedures and systems to meet best global standards.

The ISO 9001:2015 is the most widely used quality management system globally. It provides a framework that ensures that organizations are able to meet customers’ and other applicable requirements consistently. It consists of policies, processes and procedures required for planning and execution that guarantee continuous improvement and operational efficiency in the core business areas of an organization. This helps to mitigate risks, optimise opportunities and the organization is able to deliver better products/ services and sustainable excellent stakeholders experience. The SON audit of FCMB covered key areas including context of the organisation, leadership, planning, support and operation. Others were performance evaluation and improvement. Following this, SON stated in its report that, it discovered that the Bank had put in place and implemented, ‘’good practices, high quality management system awareness and risk/mitigation inbuilt in each process activity’’. It added that the lender also ensured, ‘’adequate evaluation of performance monitoring, measurement, reporting and reviewing against key performance objectives, service provision was under control and customer satisfaction monitored and analysed’’.

In his comment at the certificate presentation ceremony on May 16, 2018 in Lagos, the Managing Director of FCMB, Mr. Adam Nuru, described the laurel as another milestone in the commitment of the Bank to attain excellence in all aspects of operations and service delivery. “The award of ISO 9001:2015 certificate is an endorsement of our ability to consistently demonstrate commitment to continuous improvement in order to match the ever-changing needs of our esteemed customers, and in response to market demands and the global dynamics. We regularly ensure the internal appraisal of the risks and opportunities inherent in our business and thereafter take proactive steps to mitigate the identified risks, while optimising the opportunities for the ultimate benefit of our customers, stakeholders and the country’’, he said.

While expressing appreciation to SON for the award, Mr. Nuru added that, ‘’this is another proof that the focused execution of our strategic plan, systems, processes and procedures are yielding the desired results and recognition. Our goal is to make FCMB the centrepiece of excellence’’. In his speech, the Director General/Chief Executive, Standards Organisation of Nigeria (SON), Mr. Osita Aboloma, commended FCMB for distinguishing itself as an organisation committed to a culture of continuous improvement, professionalism and best practices. According to him, ‘’this achievement is a demonstration of the Bank’s management system’s conformity to internationally acceptable standard requirements with focus on continual improvement’’.

Mr. Aboloma, who was represented by the Director of Standards, SON, Mrs. Chinyere Egwuonwu, added that, ‘’the ISO 9001:2015 Quality Management System approach now provides FCMB a robust, globally recognised and acceptable solution to address the challenges associated with consistently meeting requirements and addressing future needs and expectations of your customers in an increasingly dynamic banking and business environment. The adoption of the latest version of ISO 9001:2015 Quality Management System framework reflects your vision to be the leading financial services Group of African origin. This is an indication of focus on customer satisfaction too’’. First City Monument Bank (FCMB) Limited is a member of FCMB Group Plc, which is one of the leading financial services institutions in Nigeria with subsidiaries that are market leaders in their respective segments. Having successfully transformed to a retail and commercial banking-led group, FCMB expects to continue to distinguish itself by delivering exceptional services, while enhancing the growth and achievement of the personal and business aspirations of its customers.

UN Secretary-General appoints Bola Adesola, CEO, Standard Chartered Bank Nigeria, as new UN Global Compact Board Vice-Chairs

(New York, 20 April 2018) – UN Secretary-General António Guterres announced the appointment of Bola Adesola to serve as a new Vice-Chair of the Board of the United Nations Global Compact. She will co-Vice Chair with Paul Polman

Bola Adesola succeeds the out-going Vice-Chair of the UN Global Compact Board, Sir Mark Moody-Stuart, former Chairman of Royal Dutch/Shell Group of Companies and of Anglo American plc.

Adesola and Polman previously served on the UN Global Compact Board, and bring significant expertise to the role from their wealth of experience in the private sector, the corporate sustainability space and specifically with the UN Global Compact itself.

Adesola is the Chief Executive Officer and Managing Director of Standard Chartered Bank Nigeria Ltd , a role she has held since 2011. She has over 25 years of banking experience, having held various leadership positions in First Bank of Nigeria, Citibank and Kakawa Discount House. Adesola is an alumnus of Harvard Business School and Lagos Business School, and she also holds a Law degree from the University of Buckingham.

Adesola and Polman have been long-standing supporters of the UN Global Compact, and were both featured at UN Global Compact events held during the 72nd Regular Session of the UN General Assembly in 2017.

In her address to the United Nations Private Sector Forum on 18 September, Adesola said,

“I urge the companies present here to look at your businesses, map them to the SDGs, and then see how you can enhance those activities and play to your strengths, because, I think, it’s all about impact, and everything we do counts — whether it’s paper, whether it’s light — they all count.”

The UN Global Compact Board has a vital role to play in shaping the strategy and policy of the initiative, which acts as the United Nations flagship for responsible business action. Designed as a multi-stakeholder body, the Board provides ongoing strategic and policy advice for the initiative. Board members are considered champions who are willing and able to advance the mission of the UN Global Compact to mobilize a global movement of sustainable companies and stakeholders to create the world we want. They act in a personal, honorary and unpaid capacity.

Secretary-General António Guterres serves as Chair of the UN Global Compact Board, having assumed the role in conjunction with his appointment as Secretary-General in 2017 following the tenure of Ban Ki-moon. Going forward, he will work closely with Adesola and Polman, along with UN Global Compact CEO & Executive Director Lise Kingo, as they lead the UN Global Compact — the entry point for business within the broader United Nations system and the largest corporate sustainability initiative in the world.

FCMB Restates Commitment to Tourism, Felicitates with Ijebuland on Ojude Oba Festival

PRESS RELEASE

First City Monument Bank (FCMB) Limited has reiterated its commitment to support activities that promote and add value to Nigeria’s culture and heritage which are alsocapable of boosting tourism and other non-oil sectorsin line with the Federal government’s ongoing drive to diversify the country’s economy. According to the Bank, this is the rationale behind its decade long support for the annual Ojude Oba Festival, a carnival-like celebration of the traditional, cultural, spiritual, economic and other accomplishments of the people of Ijebuland in Ogun state. Consequently, FCMB has assured its stakeholders that its participation in this year’s Festival, which holds in Ijebu-Ode on September 3, 2017 will be grand, exciting and rewarding for the thousands of people within and outside the country that would grace the fiesta. The Group Head, Corporate Affairs of FCMB, Mr. Diran Olojo, gave the assurance at a press conference held on August 22, 2017 at Ijebu Ode, to kick-off activities for the Festival. FCMB has over the years been a major sponsor of the Ojude Oba Festival and has continued to play a significant role in ensuring its success.

The Ojude Oba (which in Ijebu dialect means, the king’s fore-court or frontage) is a major festival in Nigeria that began over 100 years ago. It brings together all sons and daughters of Ijebuland in Nigeria and diaspora. During the Festival, various age groups (popularly known as the Regberegbes), indigenes, their friends and associates from far and near – all in their colourful costumes and riding on horses – throng the palace of the Awujale and Paramount Ruler of Ijebuland to pay homage to him amidst prayers, songs, tributes and other fun-filled activities. Apart from serving as a distinctive platform to reconnect with the values that sustain the town’s rich history, heritage and industrious uniqueness, the festival also goes a long way to boost business activities, tourism and the general hospitality sector in the area.

In a goodwill message to the Awujale of Ijebuland, Oba (Dr.) Sikiru Adetona, the Group Chief Executive of FCMB Group Plc, Mr. Ladi Balogun, congratulated the monarch, sons and daughters of Ijebuland for promoting the values of the ancient city through the festival and other socio-economic activities. He stated that FCMB is committed to the longevity of the Ojude Oba Festival and the economic prosperity of Ijebuland, just as he urged the people to see the Festival as a fulcrum to inspire individuals and businesses for heightened creativity and increased productivity. According to him, ‘’over the years, the Ojude Oba Festival has grown to become the most popular gathering of the people of Ijebuland and a significant tourist attraction. With her large diaspora population, talented artists and rich cultural diversity, Nigeria is well positioned to reap the opportunities that globalisation presents to showcase her artistry and festivals, whilst bringing increased economic activity to communities that host such, such as Ijebu Ode. As we seek to diversify our economy, tourism and culture represent a low hanging fruit that must not go untapped’’.

In the same vein, the Founder of FCMB Group who is also the the Olori Omo-Oba Akile Ijebu, Otunba (Dr.) Michael Olasubomi Balogun, CON, in a goodwill message to the paramount ruler of Ijebuland expressed his gratitude to the Awujale, especially the paramount ruler’s selflessness in attending to the different requests and yearnings of the people of Ijebuland. In a message delivered on his behalf by Mr. Diran Olojo, the Bank’s Head of Corporate Affairs, Otunba Balogun commended Oba Adetona for his distinguished and exemplary leadership over the years. ‘’I for one continue to be proud as your Olori Omo-Oba to lead the way in showing our appreciation by being very close to you and showing unflinching loyalty. Let me thank you and the good Lord, our Maker that you have been unrelenting in showing that you appreciate my regular homage and tribute to you. I can say without fear of anybody gainsaying it that from year to year, on a daily basis, the appreciation of all Ijebus for the way you extend yourself to their different requests and yearnings, is such that the annual paying of homage, is not just the only occasion we would want to be showing our appreciation because you continuously earn our affection and our adulation’’, Otunba Balogun emphasised. while congratulating the entire indigenes of Ijebuland, the FCMB Founder also prayed that the monarch’s reign would continue to bring joy and prosperity in abundance to the entire Ijebu race, at home and in the diaspora.

First City Monument Bank (FCMB) is a member of FCMB Group Plc, which is one of the leading financial services institutions in Nigeria with subsidiaries that are market leaders in their respective segments. Having successfully transformed to a retail and commercial banking-led group, FCMB expects to continue to distinguish itself by delivering exceptional services, while enhancing the growth and achievement of the personal and business aspirations of its customers.

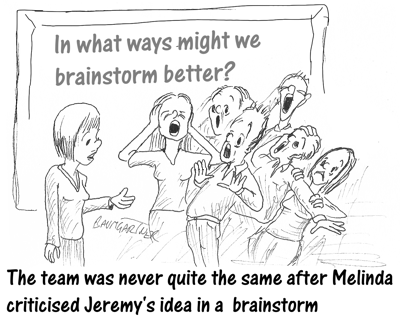

Actually, Criticizing Ideas Is Good for Creativity By Jeffrey Baumgartner

Ever since it was first invented by Alex Osborn in the 1950s or so, the fundamental rule of brainstorming, and just about every creative thinking method, has been, “Though shalt not criticise ideas.”

Mr Osborn never made it entirely clear why it is so bad to criticise ideas, though it is implied that you might hurt people’s feelings, inhibit creativity and possibly emotionally scar someone for life. Clearly then it is best to welcome all ideas with compliments, even if they are stupid, and never, ever criticise an idea. At least, that was the assumption

No one dared question this assumption for more than half a century − until 2008 when a couple of bright sparks at Berkeley University, Matthew Feinberg and Charlan Nemeth*, decided it was time to ask some questions. They conducted a study in which they put volunteers into teams and divided those teams into three three groups. One group followed traditional brainstorming rules. The second group were also told to follow brainstorming protocol with the exception that they were actively encouraged to criticise ideas. The third group was the control group. They were just told to come up with ideas any way they wanted to do.

So, what happened?

The control group’s outcome was the least creative. Only moderately better were the traditional brainstormers. By far the most creative group was the group that had been encouraged to criticise ideas.

This surprised a lot of people, especially people involved in creative facilitation. Their fundamental rule had been proven to be, well, completely wrong. Many professional brainstorming facilitators simply denied the results rather than accept their method might be flawed.

Others tried brainstorming and other ideation methods in which we actively encourage criticism during the ideation. I certainly did. And, I found it was surprisingly effective. In my experience, results are far better than when criticism is forbidden.

I believe there are several reasons why this is so.

- Blindly praising every idea encourages mediocrity. Why be bold when your boring ideas get praise?

- Criticising an idea starts a conversation about the idea as well as your needs, restrictions, assumptions and more. When ideas cannot be criticised, you cannot delve into them. You cannot really discuss them. You certainly cannot build upon them until you’ve discovered the weaknesses that need improving.

- Criticising an idea gives it importance. When all ideas are “great” the compliment becomes meaningless. When someone stops to listen to an idea, thinks about it and addresses its weaknesses, she is saying, “this idea has meaning to me. I want to talk about it.”

- Criticising ideas gives guidance. If an idea is criticised, debated and rightly found not to be viable, this tells people to think in a new direction.

No Downward Spiral

Brainstorm fans often worry that allowing criticism of ideas will lead to a downward spiral where everyone is negative and no new ideas are developed. In my experience, this does not happen. I believe it is because when a group of people in an organisation are trying to build ideas, they have a common goal in building a relevant idea that achieves their needs. Bring relentlessly critical will not get them to their goal. Being productively critical will.

Three Rules

In anticonventional thinking (ACT), an alternative to brainstorming that encourages criticism, there are three rules.

- Always criticise boring, conventional ideas. You do not want them.

- Criticises the idea is OK; criticising the person is not OK.

- Once you have criticised and idea, shut up and let the originator of the idea, or anyone else, defend it.

I have found these rules, together with encouragement to criticise ideas, ensures that critical discussions are meaningful and feelings are not hurt. Ironically, several people have told me after ACT sessions that criticism of ideas makes them feel freer and less constricted than when they cannot criticise ideas.

Go On, Give It a Try

If you run brainstorms and have always adhered to Mr Osborn’s rule that you must withhold criticism, I suggest you experiment with ideation that welcomes crticism and see what happens. Mr Osborn surely would not mind. After all, he was a fan of creativity and trying out new ideas. Moreover, I believe you will be pleasantly surprised by the results.

- Published in Blog

Allow us to tell you a short story…

Allow us to tell you a short story….

Mr. and Mrs. John Lagbaja built a modest 4 bedroom duplex in Ilupeju, Lagos. It took them six years and a great deal of sacrifice following the graduation of their youngest child from the university. Years of saving and investment paid off as they were finally able to move into their own home. It was a dream come true as excited friends and well-wishers attended the formal “house-warming” party. Prayers were offered by their parish priest and the small crowd assented to his prayers with cries of “Amen!”

Their first child who lived in the US sent them some money to furnish the new house as only new furniture and fittings would do. Mr. Lagbaja had prudently used the money to furnish and equip their new home with electronics, furniture, fittings, some security gadgets etc. only relinquishing control to his wife when it came to furnishing the kitchen! The Lagbajas were now landlords in Lagos.

7 months later on a warm February night, Mr. John Lagbaja who was the lighter sleeper woke up to sounds of faint shouting. He looked at his watch and it was 3am in the morning. What was going on? His phone started to ring. He grabbed it and it was then he detected the smell of smoke. The call was from a neighbour: “Sir! Fire! Fire! Your house is on fire!!” He quickly woke his wife and ran out of the house.

By 5am the fire had been put out through a combined effort of volunteers and the fire-fighting service but the damage caused by the fire was considerable. Two rooms with their toilet and bathrooms were burnt from floor to roof. The ceiling and roof of their bedroom was also affected. Black smoke had darkened the walls and the heat had melted the wiring and other parts. Water from the hoses had left every other thing soaking wet.

The Lagbajas wept and tried to console each other. How would they recover from this?

(Alternate ending)

As Mrs. Lagbaja wept her husband tried to console her, assuring her that everything would be fine. A few days later the Lagbajas received a cheque from AXA Mansard. His prudence had paid off.

The AXA Mansard Home Insurance plan protects you and your home against the risk of fire, flood, burglary etc. It does not matter whether you own a house, live in a rented apartment or you are sharing with friends or family, we offer you and your property and belongings protection from total loss.

For more information, please visit our website at www.axamansard.com, or email us at insurancecare@axamansard.com. You can also call us on 0700 AXA Mansard.

Let’s protect you.

AXA Mansard

4.5 Million Nigerians Suffer from Hypertension

What is Hypertension?

Hypertension or High Blood Pressure is when the long-term force of the blood against your artery walls is high enough that it may eventually cause health problems, such as heart disease.

How do you measure blood pressure?

Blood pressure is determined both by the amount of blood your heart pumps and the amount of resistance to blood flow in your arteries.

What are the symptoms of hypertension?

You can have high blood pressure (hypertension) for years without any symptoms. High blood pressure generally develops over many years, and it affects nearly everyone eventually.

Hypertension amongst Nigerians

The Federal Ministry of Health of Nigeria has revealed that a total of 4.5 million Nigerians are living with hypertension. Even more worrying is the fact that the rate of this disease is rapidly growing, especially in urban areas of the country.

Hypertension has become such an issue in Nigeria that the federal government and Neimeth Pharmaceutical International have pledged to reduce the high rate of the non-communicable disease.

Federal Ministry of Health’s Permanent Secretary, Mr. Linus Awute, said: “The health sector is inundated with many challenges, hypertension as a non-communicable disease is one of them. We want to use this opportunity to work with Neimeth Pharmaceutical, making it a wonderful intervention.”

The Managing Director of Neimeth Pharmaceutical International, Emmanuel Ekunno assured stakeholders that the company would remain steadfast in supporting efforts to fight hypertension.

Common diseases such as hypertension can be treated and controlled, but they need to be diagnosed as early as possible. The treatment needs to be tailored and managed well, healthcare plans remove the risk of financial problems delaying treatment.

- Published in Blog

SUPER SEVEN FC PICKS NIGERIA’S TICKET TO REGIONAL FINAL

Nigeria is to be represented at the regional circuit of the ongoing Standard Chartered Bank’s Road to Anfield five-a-side competition by Super Seven FC.

Mrs Yetunde Oni, Head Commercial Clients, Standard Chartered Bank (3rd left), presenting the Trophy to Captain of Super Seven Football Club, Ojo Babatunde Damilola, the winner of the just concluded Standard Chartered Road to Anfield 2015 competition.

Super Seven bagged the ticket to the regional final in Accra, Ghana after defeating Dobber FC 6-5 in a penalty shoot-out at the Astro Turf ground in Lekki, Lagos. Neither of the two sides could end the scoreless deadlock at regulation time. Also to join Nigeria and host Ghana at the Accra soccer fiesta is The Ghana. The three are to battle for the West African ticket to Anfield in the UK where the winners of the East and Southern African regions will also play.

According to the Sub-Regional Head, Brands & Marketing, West Africa of Standard Chartered Bank, Diran Olojo, the ‘Standard Chartered Trophy’ is an international five-a-side football tournament organised by the bank in partnership with Liverpool FC.

“It offers football fans a once in a life time, money can’t buy, opportunity of playing at an English Premier League football pitch as well as been coached by Liverpool FC’s Manager, Brenda Rodgers,” observed Olojo at the trophy presentation at the weekend.

Standard Chartered’s global footprints will compete for the ultimate trophy on May 7 and 8, 2015. The winners of the ‘Finals’ will be crowned overall champions of the ‘Standard Chartered Trophy 2015’.

Also speaking at the end of the national final last Sunday, Country Head, Corporate Affairs, Standard Chartered Bank, Nigeria, Dayo Aderugbo, expressed her happiness at the level of performance of the players and the huge turnout of football fans.

“I am so excited with the level of performance. We have a huge turnout. 36 teams registered and contested in the championship. So, regardless of the club you support, it’s a chance to come together and win together and go and play in Anfield, the home of Liverpool FC,” she noted with excitement.