FCAM’s Legacy Short Maturity (NGN) Fund Holds AGM … Fund Returns 12.99% in Fund Year-ended 30 June, 2017

Unitholders of Legacy Short Maturity (NGN) Fund, a mutual fund managed by First City Asset Management Limited (FCAM), converged in Lagos on January 8, 2018 for the Annual General Meeting (AGM) of the Fund. FCAM is the wealth and investment management arm of FCMB Group Plc, one of Nigeria’s leading financial institutions. At the meeting, the unitholders approved the financial statements of the Fund for the year ended June 30, 2017, while also applauding it for generating returns of 12.99% despite the challenging operating environment. They also unanimously endorsed the payment of a dividend of 11kobo per unit as well as the name change of the Fund from Legacy Short Maturity (NGN) Fund to Legacy Debt Fund, among other resolutions passed at the meeting.

Unitholders of Legacy Short Maturity (NGN) Fund, a mutual fund managed by First City Asset Management Limited (FCAM), converged in Lagos on January 8, 2018 for the Annual General Meeting (AGM) of the Fund. FCAM is the wealth and investment management arm of FCMB Group Plc, one of Nigeria’s leading financial institutions. At the meeting, the unitholders approved the financial statements of the Fund for the year ended June 30, 2017, while also applauding it for generating returns of 12.99% despite the challenging operating environment. They also unanimously endorsed the payment of a dividend of 11kobo per unit as well as the name change of the Fund from Legacy Short Maturity (NGN) Fund to Legacy Debt Fund, among other resolutions passed at the meeting.

In the audited results for the year ended June 30, 2017, Legacy Short Maturity (NGN) Fund recorded a profit after tax of N100.487million, as against N50.343 million realised in the previous Fund Year. In addition, total revenue generated by the Fund rose from N63.422 million, to N119.005 million.

Speaking on the performance of the Legacy Short Maturity (NGN) Fund at the AGM, the Chief Executive Officer of First City Asset Management Limited, FCAM), Mr. James Ilori, stated that although the return of 12.99% was lower than the 16.82% return of the Fund’s benchmark, the Fund carried significantly lower interest rate risk relative to its benchmark. Also, the Fund’s risk-rating was upgraded by Agusto & Co. Fund performance is expected to improve significantly in the new Fund year.

The Legacy Short Maturity (NGN) Fund seeks to preserve capital and generate consistent income for unit holders. The Fund pursues its investment objectives by investing in high quality, Naira-denominated Money Market Instruments and short maturity bonds rated by a Securities & Exchange Commission (SEC) registered credit rating agency. Trading and Settlement is done on a best execution basis. In addition, the Fund is highly liquid and well diversified. Proceeds to investors, at the point of exiting the Fund, are tax free the Legacy Short Maturity (NGN) Fund rating was, in December 2017, upgraded by two notches, from BBB+(f) to A(f), by Agusto & Co, the foremost pan-African rating agency. The higher rating of A(f) indicates that Legacy Short Maturity (NGN) Fund has a low to moderate exposure to downside risk (impairment to the net asset value) in the medium term. According to Agusto & Co, the new rating was on account of the Fund’s good quality assets, adequate liquidity management strategies, conservative approach to credit risk & enhanced risk management, and zero currency risk exposure.

In addition, the rating agency stated that interest rate risk in the Fund was moderate in the short term, and that the Fund has a high quality portfolio management team with over 18 years’ experience across various financial fields. FCAM, a subsidiary of FCMB Group Plc, provides services that cut-across collective investment schemes such as mutual funds, which are predominantly for retail investors, as well as specialised discretionary portfolio management, for ultra-high and high networth individuals and institutional investors. The company has consistently focused on delivering superior wealth and investment management services, aimed at meeting investors’ desire for safety of investments and good returns. In October 2017, Legacy Short Maturity (NGN) Fund was nominated for “Best Fixed Income Fund” and Legacy Equity Fund won the award of ‘’Best Managed Fund in Equity’’, at the BusinessDay Banking Awards. FCAM’s market counterparties include CSL Stockbrokers Limited and First City Monument Bank Limited.

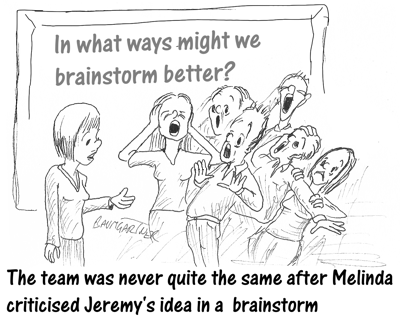

Actually, Criticizing Ideas Is Good for Creativity By Jeffrey Baumgartner

Ever since it was first invented by Alex Osborn in the 1950s or so, the fundamental rule of brainstorming, and just about every creative thinking method, has been, “Though shalt not criticise ideas.”

Mr Osborn never made it entirely clear why it is so bad to criticise ideas, though it is implied that you might hurt people’s feelings, inhibit creativity and possibly emotionally scar someone for life. Clearly then it is best to welcome all ideas with compliments, even if they are stupid, and never, ever criticise an idea. At least, that was the assumption

No one dared question this assumption for more than half a century − until 2008 when a couple of bright sparks at Berkeley University, Matthew Feinberg and Charlan Nemeth*, decided it was time to ask some questions. They conducted a study in which they put volunteers into teams and divided those teams into three three groups. One group followed traditional brainstorming rules. The second group were also told to follow brainstorming protocol with the exception that they were actively encouraged to criticise ideas. The third group was the control group. They were just told to come up with ideas any way they wanted to do.

So, what happened?

The control group’s outcome was the least creative. Only moderately better were the traditional brainstormers. By far the most creative group was the group that had been encouraged to criticise ideas.

This surprised a lot of people, especially people involved in creative facilitation. Their fundamental rule had been proven to be, well, completely wrong. Many professional brainstorming facilitators simply denied the results rather than accept their method might be flawed.

Others tried brainstorming and other ideation methods in which we actively encourage criticism during the ideation. I certainly did. And, I found it was surprisingly effective. In my experience, results are far better than when criticism is forbidden.

I believe there are several reasons why this is so.

- Blindly praising every idea encourages mediocrity. Why be bold when your boring ideas get praise?

- Criticising an idea starts a conversation about the idea as well as your needs, restrictions, assumptions and more. When ideas cannot be criticised, you cannot delve into them. You cannot really discuss them. You certainly cannot build upon them until you’ve discovered the weaknesses that need improving.

- Criticising an idea gives it importance. When all ideas are “great” the compliment becomes meaningless. When someone stops to listen to an idea, thinks about it and addresses its weaknesses, she is saying, “this idea has meaning to me. I want to talk about it.”

- Criticising ideas gives guidance. If an idea is criticised, debated and rightly found not to be viable, this tells people to think in a new direction.

No Downward Spiral

Brainstorm fans often worry that allowing criticism of ideas will lead to a downward spiral where everyone is negative and no new ideas are developed. In my experience, this does not happen. I believe it is because when a group of people in an organisation are trying to build ideas, they have a common goal in building a relevant idea that achieves their needs. Bring relentlessly critical will not get them to their goal. Being productively critical will.

Three Rules

In anticonventional thinking (ACT), an alternative to brainstorming that encourages criticism, there are three rules.

- Always criticise boring, conventional ideas. You do not want them.

- Criticises the idea is OK; criticising the person is not OK.

- Once you have criticised and idea, shut up and let the originator of the idea, or anyone else, defend it.

I have found these rules, together with encouragement to criticise ideas, ensures that critical discussions are meaningful and feelings are not hurt. Ironically, several people have told me after ACT sessions that criticism of ideas makes them feel freer and less constricted than when they cannot criticise ideas.

Go On, Give It a Try

If you run brainstorms and have always adhered to Mr Osborn’s rule that you must withhold criticism, I suggest you experiment with ideation that welcomes crticism and see what happens. Mr Osborn surely would not mind. After all, he was a fan of creativity and trying out new ideas. Moreover, I believe you will be pleasantly surprised by the results.

- Published in Blog

A.M. BEST UPGRADES RATING OF AXA MANSARD INSURANCE PLC TO BBB-

AXA Mansard Insurance plc. has today announced the upgrade of its rating by the global insurance rating agency, A.M. Best, from “bb+” (Fair) to “bbb-” (Good) for the Issuer Credit Rating (ICR) and “B” (Fair) to “B+” (Good) for Financial Strength Rating (FSR). The rating agency also assigned a positive outlook to the rating.

A.M. Best in its press release stated that “the positive outlook reflects AXA Mansard’s consistent excellent underwriting performance, as demonstrated by the five-year average non-life combined ratio of 83%”. The agency further stated that “A.M. Best expects AXA Mansard’s underwriting earnings to remain strong, supported by its solid competitive position as a top five composite Insurer in Nigeria, the benefit of its wide and expanding distribution network, as well as effective risk management”.

This rating remains the highest rating received from A.M. Best by any Nigerian Insurer and second highest received by any Insurer in sub-Saharan Africa. AXA Mansard Insurance remains an outstanding Insurer with strong financial strength and excellent underwriting capabilities. The organization has demonstrated this over the years through its superior financial and technical competencies.

In the first half of 2015, AXA Mansard reported a 7% increase in Net Premium Income, 18% growth in Profit Before Tax, whilst sustaining significant growth in the Health Insurance and Investment segments. AXA Mansard has achieved measurable results through the effective implementation of sound risk management principles which reflect in the Company’s recognition at the recent Nigerian Risk Awards. The company has also received several other awards including the Award for Promptness in Claims Settlement by LCCI and was also recently adjudged one of the top 50 Brands in Nigeria.

Commenting on the rating, Mr. Tosin Runsewe (Chief Client Officer) said “We are delighted that our quest to build a world class insurance company with global expertise and local competence has not gone unnoticed. The upgrade of our A.M.Best rating to an amazing BBB- clearly emphasizes our leading position and further validates our capacity to provide superior security for our discerning customers, both local and multinational”.

A.M. Best Company is a global credit rating agency with over 100 years history of providing quantitative and qualitative assessment for Insurance companies, with its “Best’s Credit Rating Methodology” used to determine the financial strength and creditworthiness of Insurance companies. A.M Best is the world’s oldest and most authoritative insurance rating and information source. For more information, visit www.ambest.com.

AXA Mansard rated among Top 50 Brands in Nigeria

AXA Mansard Insurance continues to receive top ratings amongst other brands. AXA Mansard Insurance was rated among the Top 50 Brands in Nigeria by APT Brand International Limited.

Top 50 Brands in Nigeria is an annual selection of top brands in Nigeria. The award criteria include leadership structure, market acceptance, brand equity, product offerings, culture, quality service delivery and market performance.

The record is indeed significant for AXA Mansard Insurance as it is the only insurance company to receive this outstanding recognition along with other highly rated brands in the country.

The Chief Client Officer, Tosin Runsewe commented that “Our brand has grown over time and has become a symbol of our desire to keep evolving new ways of pleasing our customers. The value of our brand represents the value we place on our customers and serves as a hallmark of our brand promise to them to protect their assets, health and loved ones”.

Adding to this, the Group Head Strategy and Marketing, Kola Oni, says “We are delighted to receive this award for the second year in a row. The AXA Mansard brand is unique and this award is dedicated to our customers who have supported us over time even as they recognize and appreciate the AXA Mansard experience”.